### 國債的基本運作

#### 甚麼是國債

基本上,國債就是國家欠的債。欠債的對象可以是國民、外國人、金融機構或者其他國家。所以同樣可以理解成國家在借錢,去應付營運一個國家的開支。就像一家茶餐廳,要付開支,包括租金、人工、食材、廚具。你可能會問,不是有創業本金或者營運收入的嗎?為甚麼一定要借貸?如果以茶餐廳的角度,借貸的好處是可以擴大經濟規模,可以用較少的本金,甚至無本金去生利,亦不受限於資金回籠,總不能等待有充足收入時才去付開支。況且市道有週期,沒有人保證生意能長期賺錢,沒有收入的日子,開支還是要付,所以借貸就成了其中一項支金來源。國家也是一樣,只不過是一間更大更複雜的公司。國防、基建、福利、人工等等就是國家的開支,而國家用的錢,其中一個來源就是借回來。

支付開資的錢是借回來,那是從哪裡借回來?任何人。你和我也可以買到國債,但你我等普通百姓,為甚麼會想借錢給國家,錢太多了嗎?還真的是。如果你是一個月光族,每月賺多少花多少,那的確和你無關。但如果你每賺的錢多於你花的錢,比如說你月入$10000,開支付$8000。你有$2000剩,你想把它儲起來供日後花費。可能你只是想積谷防飢,又或都計劃將來的讀書、首期等。但這時候你要面對一個問題:「通漲」。物價有可能隨時間上升,你今天買一個模型要$100,如果你面對2%的通漲,明年就要$102才能買到。你今年存起的$100所代表的價值,去到明年就經已貶值,不值今年的$100。但現在你有一個選擇,你可以成為別人的債主。因為當你借錢出去的時候,你是可以收回利息的,如果你借錢給別人的利息追得上通漲,那麼恭喜你,你己經成功抗通漲。

那借錢出去,借給誰?借給熟人,可以,但不算太有保障,而且會還錢的人,不一定要向你借錢;借給上市公司,他們做生意一定有借貸需求,但上市公司碰上經濟不景都可以倒閉,有沒有更可靠的選擇?有,國家。國家不會倒閉,不會跑數了吧?還真的會,不過我們現在說的是全球經濟實力最強的國家,美國。由於種種原因包括經濟、政治、軍事的實力,美國的國債是公認為無風險的資產。也就是說,美國是最不可能會走數的債仔,借錢給美國是一定可以收回本金的(理論上)。

如果你決定了借錢給美國,假設你借出USD$1000。(你和人家交易當然是用他們的貨幣),他們就會給你一張「借據」,上面列明了你借出了多少的本金,他們要支付多少利息,以及甚麼時候償還本金。這張借據就是國債了。常常聽說中國有多少美國國債在手,也可以中國借了錢給美國,有價值多少的「借據」在手。當然現代甚麼都電子化就不會有實體的債券,但以往是真的一張紙寫著剛提及的資料,還有Coupon(票息)可以撕下來(像雜誌優惠巻一樣)去領取那一期的債息。

#### 債券數字概念

為了進一步解釋更深入的概念,包括現時經濟環境,首先要搞清楚債券的幾個基礎概念。

我們回到了剛才的假設,你想借錢出去收息抗通漲,又或都換個說法,你想買美國債券。買多少?你剛好有$1000美金。但你又不是一個想得很長遠的人,你不想借出去太長時間;又或者只要多一年時間你就儲夠錢買你想要的東西。那麼我們就挑一年期的美國債券。那代表甚麼?代表你花了一USD$1000買了一張USD$1000面值的一年期美國債券,期間你會收到相應的利息,一年後你會收回USD$1000的本金。現時一年期美國債券的票息大概是4.3%。那你一年後可以獲取的就是你的本金(USD $1000)以及一年的利息(1000 x 4.3% = USD $43),總數是USD $1043。這是如果這一年的通脹不超過4.3%,你就成功抗通漲了。不過現實世界的一年期貸算計有一點點不一樣,雖然原則是不變的。短年期的國債叫做Bills,你一年後會收回USD $1000,那已經是本金連利息,你是以折扣價的本金去買入。

本金 x (1 + 利率) = 票面價值(就是你的最後會收回的所有錢)。

本金 x (1 +4.3%) = 1000

本金 = 1000/1.043

本金 = 958.77

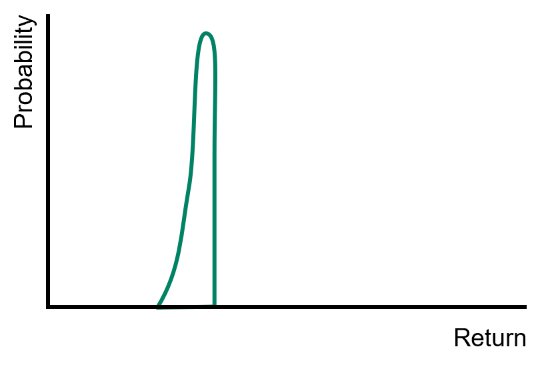

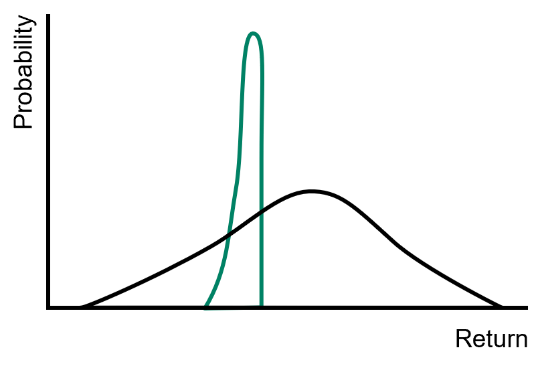

所以你買一年期(Maturity)USD $1000(Face Value)的債卷,你是花USD $958.77(Price)去購買的,而票面息率就是4.3%(Coupon)。債券是可以在市場上自由交易的,所以供應和需求都會影響到價格,票面價值為USD $1000 4.3%Coupon rate的債券,發行時價值$958.77,但在交易時可能會是以$960或者$956成交,這張債券最後到期時你還是會得到$1000,但你付出你的成本不同,你獲得的利息也不同。假設你以$960成交

本金 x (1 + 利息) = 票面價值

960x (1 + 利率) = 1000

利率 = 1000/960 -1 = 4.1666667%

這個以交易價計算出來的利率4.167%就稱為收益率/殖利率(yield)了。不難看出,yield和price是持相反關係的。